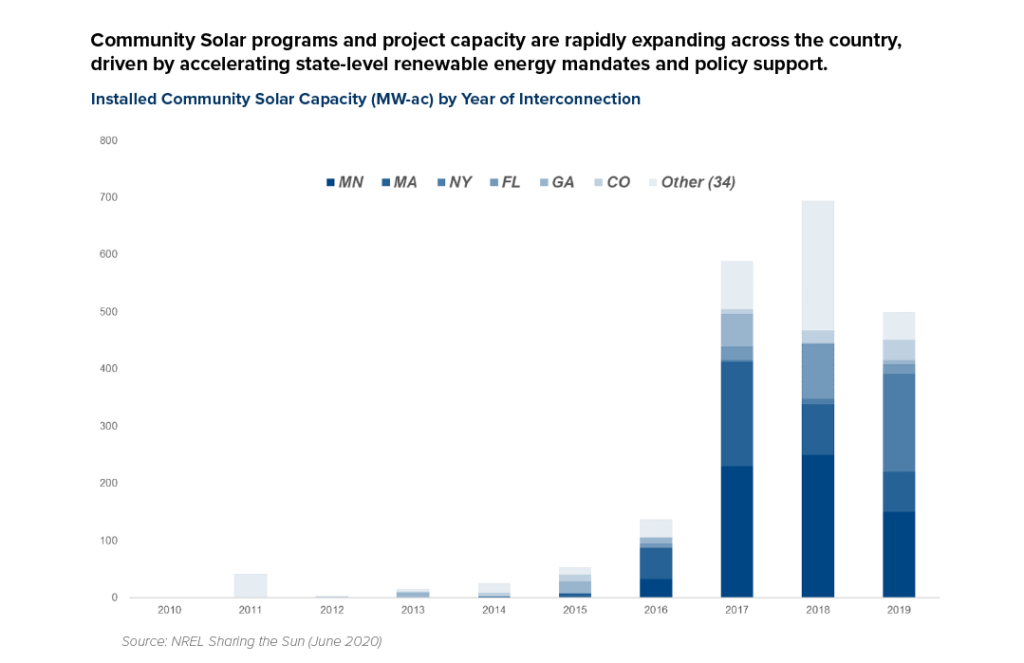

Corporate interest and participation in Community Solar has exploded in recent years, as a growing number of states enact legislation creating new market opportunities. Fueled by ambitious state policies tackling power sector emissions, such as New York’s 100% carbon-free by 2040 mandate, Community Solar has become an important policy tool for promoting local solar development across the country.

Community Solar offers guaranteed savings and low-risk access to renewable energy through customer-friendly contract terms. Participation requires no on-site installations or out-of-pocket expenses – and subscriptions generally have no impact on existing power supply agreements.

Figure 1. Community Solar Growth, Installed Capacity (MW)

Once a customer enrolls in the program, they begin receiving credits on their electric utility bill. Customers are required to pay a portion (e.g., 80%-90%) of the realized savings to the solar vendor for providing this service, however there are no other payments or fees for participation. Often, the contract product or deliverable is the savings itself.

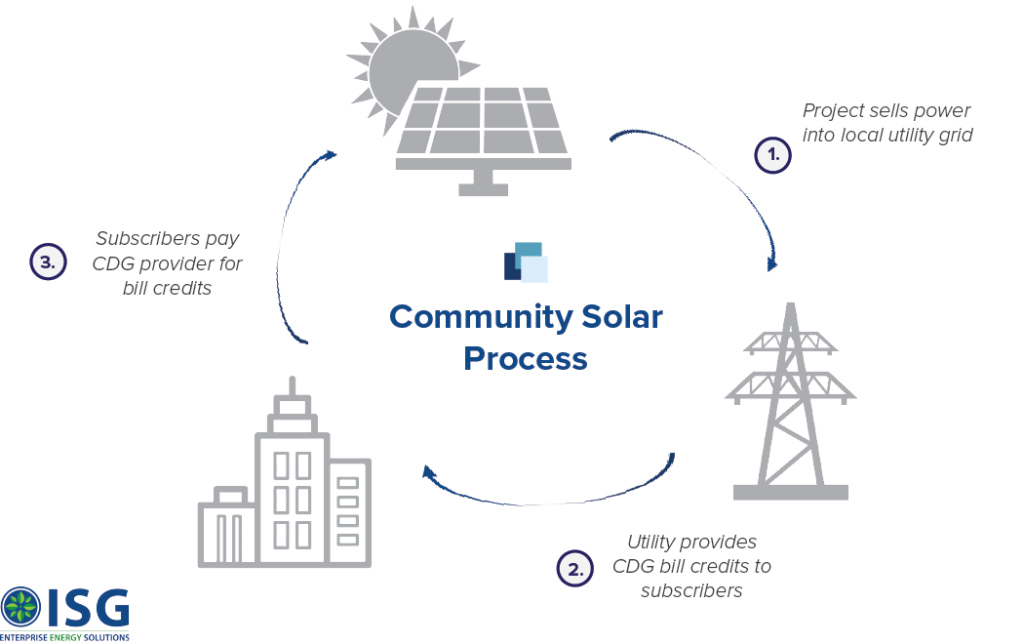

For all these reasons, participation is simple, and the value proposition is compelling. While the program structure, requirements and commercial terms vary by market, the general model is consistent across the country. To better understand the program mechanics, it is helpful to consider the upstream activities and incentives that govern solar project development.

For project developers and owners, which may or may not be the same entity, their core business is to build, operate and monetize renewable energy assets (i.e., solar farms). While this happens across the country, it occurs most predominantly in markets with more favorable policies and mechanisms for selling the power that is produced. Community Solar programs are designed to improve the attractiveness of projects by enhancing the value and stability of the revenues generated from the solar farms – thus incentivizing increased solar development.

To secure financing and monetize their projects through these programs, project developers need a specific composition of subscribers (i.e., solar tenants) to their projects. Therefore, Community Solar subscriptions from eligible customers, including most corporations, are required to maximize the economics of these projects – making subscribers highly valuable and sought-after. For developers, these subscriptions improve project revenues and reduce merchant risk. Customers are rewarded with guaranteed cash-flow improvements in exchange for their commitment as a subscriber.

Once a customer enters into a Community Solar agreement, the solar provider registers their participation with the local utility company. The subscription is generally sized based on the annual power usage and spend invoiced by the local utility. As the solar project begins to produce and sell electricity into the grid, the utility distributes a portion of the revenues to individual subscribers in the form of utility bill credits. Solar providers charge the subscribers for a portion of the realized savings, typically leaving the customer with 10% savings on their electric utility costs.

Figure 2. Community Solar Process Diagram

Although most customers are eligible to subscribe, contract terms and risk exposure varies by market, customer and meter type. The primary risk of participation lies in the potential for termination penalties upon cancellation of the contract, which has more relevance for customers that lack certainty and visibility into the future operations of their portfolio. However, even for corporations with short-term leases across most facilities, there are techniques for structuring agreements to mitigate this risk, greatly reducing the potential for cancellation fees.

When structured effectively, Community Solar is a no-brainer and can be profitably incorporated into a business’s renewable energy strategy. However Community Solar markets can also be highly fragmented and complex – involving many different project developers and operators, each with unique contract terms and documents. The administrative resources required to navigate these markets can be burdensome.

We believe that finding the right partner can help alleviate these burdens. By seeking out an advisor with industry expertise, companies can dramatically reduce the time and resources required to capture the benefits of the programs. An independent advisor can help customers efficiently confirm eligibility, quantify the opportunity, evaluate vendors and negotiate contracts to secure favorable terms.

ISG is one such advisor that benefits from the scale and experience across a diverse client base, giving us a unique perspective and insight into the industry. ISG maintains an extensive network of project developers and operators, giving us broad visibility into available capacity and development pipelines across the country – allowing clients to quickly capitalize on market opportunities as new legislation is passed.

If you believe Community Solar might be a good fit for your business, we encourage you to review the questions below and reach out to our team if we can be of assistance.

-

- Are we monitoring the industry and taking advantage of new state programs as they are created?

- Have we found a provider that can deliver and will support us through the term of the agreement?

- Are we receiving competitive terms or are we leaving anything on the table?

- Have we updated our energy contracts to ensure maximum savings through Community Solar?

- Have we properly negotiated and structured our agreement to manage termination risk?

- Do we have a scalable contract infrastructure to support expansion into new markets as they open up?

- Does our subscription include Renewable Energy Certificates (RECs), and if not, can we include them?

- Are we accurately and truthfully communicating the environmental impacts of our agreement?