How your corporate energy strategy can demonstrate a commitment to sustainability while driving savings.

by Mike Muoio, ISG Enterprise Energy Solutions

BlackRock CEO Larry Fink, co-founder of the firm that has since become the largest asset manager in the world, made waves in January with his latest annual letter to CEOs. In the letter, Fink urged executives to acknowledge the societal impacts of their businesses and to use this understanding to inform their shorter-term decisions.

Fink argues that companies without a sense of purpose – those that are unwilling to respond to broader social challenges – will succumb to short-term pressures to distribute earnings, and forgo investments needed for long-term growth. This message from BlackRock coincides with a trend of increasing awareness in the larger investment community of the value in incorporating environmental, social and governance (ESG) factors into investment decisions.

As an investment strategy, ESG analysis is largely a risk management tool that weighs exposure to important societal issues, including employee relations, data privacy, carbon emissions and much more. From a business perspective, exercising leadership on these issues is an opportunity to manage risk, drive investor confidence, improve brand image and build strong relationships with employees and the community – all of which are conducive to long-term value creation. The rise of ESG investing, together with growing demands from shareholders and customers for businesses to embrace social responsibility, will have lasting impacts on how companies make operational decisions.

“Companies must ask themselves: What role do we play in the community? How are we managing our impact on the environment? Are we adapting to technological change?”

– Larry Fink, Black Rock CEO

While the challenges that Fink alludes to in his letter are exceedingly broad in scope and are in no way limited to environmental sustainability, our clients are already receiving pressure from key customers to address environmental concerns in particular. In the past two months alone, companies such as McDonald’s, Walmart and P&G have each made formal announcements of plans to significantly reduce emissions throughout their supply chains by 2030. As these aggressive targets are rolled out across their operations, the suppliers that exist within these value chains will be heavily impacted by these policies and must begin to plan accordingly.

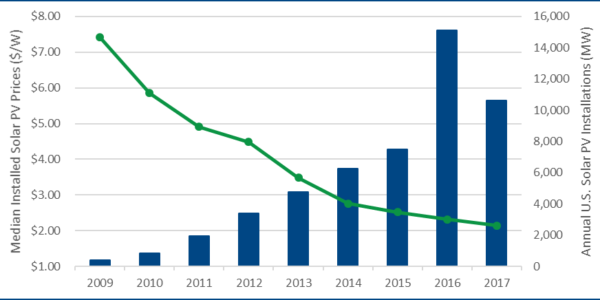

The good news: incorporating sustainability no longer requires forfeiting returns. For most businesses, the ways in which energy is purchased and consumed is the primary source of carbon emissions. In recent years, the cost of energy projects that address these concerns have plummeted due to falling technology prices. Since 2009, wind farm costs have decreased by 67 percent, while utility-scale solar has seen an 86 percent decline – and corporate renewables procurement has surged in response. The steep drop in prices for renewable energy and energy efficiency technologies has created nationwide opportunities for high-return projects, which can often be structured as cash-flow positive agreements that shield customers from operational risks.

Today, over 130 companies around the globe have committed to going 100 percent renewable, and almost half of the Fortune 500 have set renewable energy or carbon emissions reduction targets. As this market shift continues to unfold, rapid technological advancements and financial innovations are challenging the outdated perception of sustainability and cost-reduction as strictly competing priorities.

Fink suggests that executives should include social responsibility in their corporate strategy, and energy-driven emissions reduction initiatives are a logical place to start. Executing on high-return projects with positive environmental attributes should be viewed as a crucial first step towards ESG excellence for any business. Many companies understand this reality but lack the resources and expertise needed to translate a conceptual appreciation of sustainability into real projects – especially those with a compelling ROI.

New opportunities for reducing costs and improving sustainability are emerging across the country; however, the profitability of these projects can be quickly eroded if managed ineffectively. Identifying the right projects for your firm with the right team of energy experts in place to guide implementation will ensure that returns will not be compromised.