Boosting Retailer Return-on-Sales Through Effective NFR Expense Management

An Insight Sourcing Group Retail Industry Perspective

At many retailers, indirect procurement of goods and services in not-for-resale (NFR) categories does not receive the focus it deserves. Fortunately, the journey to effective NFR expense management can often be measured in quarters, not years, and the ROI is compelling. Below, we will share four best practices to reduce NFR spend by 6-10% and increase margins by 90-150 basis points.

The Challenge

For many retailers, not-for-resale (NFR) expense management falls to the bottom of the long list of strategic priorities or may not be on the organization’s radar at all. At first glance, why wouldn’t that be the case? A typical retailer spends less than 20% of sales on NFR goods and services, meaning that when it comes to addressing spend, direct merchandising procurement often receives the most focus.

Decades of experience leading strategic engagements with retailers highlight consistent themes – namely, that NFR procurement groups suffer from:

-

- Poor visibility into the organization’s spend

- Limited influence with business stakeholders/executives

- Lack of investment and training

- No process to monitor and track ongoing savings

At many organizations, an NFR-focused procurement team may not even exist at all!

Much more commonly, NFR is managed in siloes by business functions whose objectives do not include cost containment. As a result, NFR budgets grow each year without genuine challenge or thought as to true ROI. When functions with limited procurement capability have NFR vendor relationships, stakeholders can also become defensive of suppliers and resistant to challenging or negotiating with incumbent providers.

Our experience with 50+ retailers demonstrates that retailers can reduce NFR spend by 6-10% and increase margins by 90-150 basis points (bps) through effective NFR expense management. To achieve these results, retailers must make NFR expense management a strategic priority rather than an afterthought.

Our Experience

Insight Sourcing Group’s perspective has been shaped by experience partnering with 50+ retailers to transform NFR spend management practices. Example partnerships include:

- $2.2B specialty retailer operating 2,000+ stores in the U.S. and Canada

- $2.5B Private Equity-backed leading clothing and accessories retailer

- $35B retailer serving approximately 15 million customers a week in North America across more than 1,500 store locations

- $1.9B retailer operating 750 stores, with over 5,900 employees

- $4B automotive retailer operating nearly 100 dealerships and providing parts, maintenance, and collision repair services

- $3B retailer of children’s clothing with 1,000+ stores

- $500M Private Equity-backed manufacturer and retailer of luxury apparel

Quantifying the Hidden Potential in NFR Expense Management

Before we address specific best practices that operationally efficient retailers are using to manage NFR expenses, let us establish the business case.

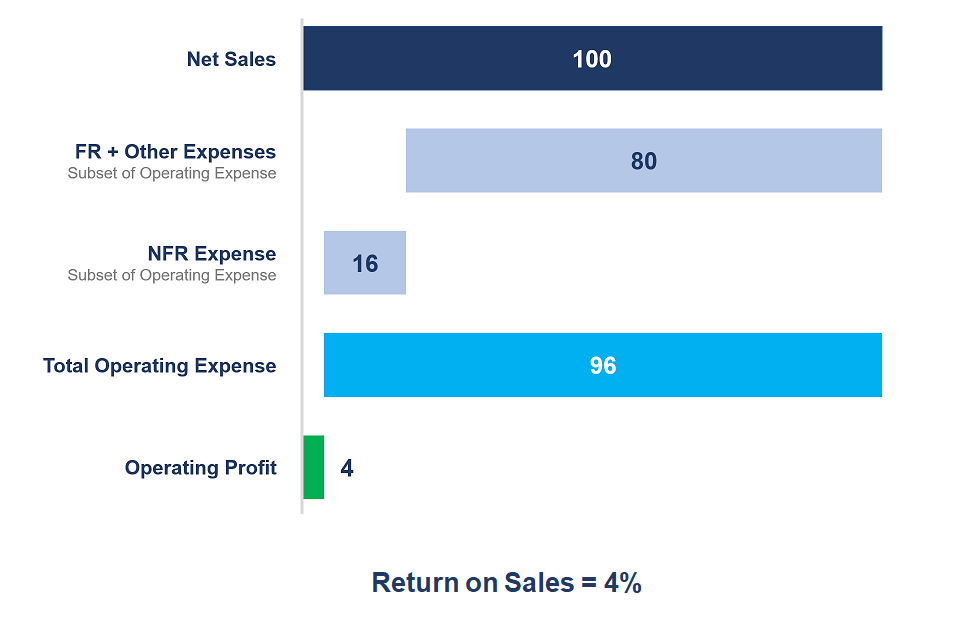

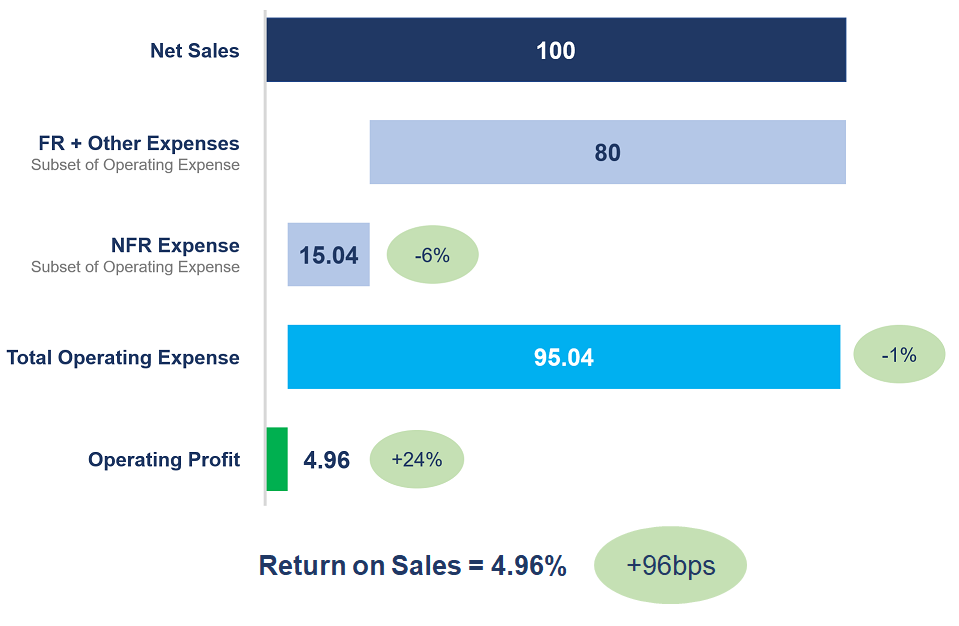

Consider the retailer below, which operates at a 4% margin, with NFR expenses representing 16% of sales (illustrated in Figure A). A focused effort on reducing NFR expenses drove an average cost reduction of 6% across NFR spend. Tracing the impact of this reduction to the P&L (Figure B), the retailer recognized an increase in return-on-sales of 96 bps, or almost 1%:

The CFO of the retailer above may be surprised to find that to drive an equivalent impact to return-on-sales, the organization would have to boost sales revenue by 24%.

4 Strategies to Effectively Control NFR Expenses

With the business case for controlling NFR expenses clear, we will now outline four strategies to convert bottom-line impact from concept to reality.

- Gain true visibility into NFR spend. While NFR spend may typically make up less than 20% of sales, more than 80% of an organization’s vendors (typically, thousands) are providing NFR goods and services. Combined with siloed buying, contract “databases” in individuals’ Outlook folders, and disparate financial systems, many NFR procurement initiatives can quickly lose steam. A clean, procurement-centric view of spend, grouping vendors providing like products and/or services into a multi-tier sourcing taxonomy (note: UNSPSC or GL codes will not suffice) is the only foundation of driving a holistic NFR cost optimization strategy.

- Develop a savings roadmap. Once spend visibility is achieved, a detailed execution plan should be developed to define sourcing opportunities, aggressive but attainable savings goals, and specific plans to achieve targets. Interviews with business owners, contract analysis, and benchmarking (where possible) will help validate targets and prioritize identified opportunities. Thought should also be given to resourcing; we recommend a hybrid approach in which opportunities are segmented and responsibilities are assigned considering elements such as the benefit of cross-organization spend aggregation and criticality to business operations.

Importantly, the roadmap should be socialized with and presented to an executive steering committee to illicit sponsorship and ensure accountability.

- Optimize total spend, pushing beyond price reductions. To maximize impact from NFR expense reduction, organizations should assume a total spend optimization (TSO) approach. Sourcing strategies for material NFR categories must consider savings levers beyond price (which can double or triple savings potential), including demand and process levers, as illustrated below:

| NFR Category | NFR Subcategory | Example Price Levers | Example Demand Levers | Example Process Levers |

|---|---|---|---|---|

| Marketing | Creative Agencies | Review agency rates against industry benchmarks, bundle spend across distinct spend areas to increase leverage | Eliminate redundant scopes to ensure there is not excessive content or campaigns, diluting overall impact and efficacy of investment | Move spend from an external agency partner to the internal team, work to more closely tie performance to compensation |

| Distribution Operations | Corrugated Boxes | Leverage total spend to implement preferred vendor and reduce unit pricing | Rationalize SKUs across DCs, challenge specifications (e.g., 32ECT to a 29ECT box strength) | Develop cost model to evaluate benefits of automated box erector/sealer |

| Technology | IT Third-Party Labor | Review rate cards to standardize roles and rates across organization, consider fixed price versus T&M models by need | Maximize leverage of offshore resources | Model ongoing expense of 3-5year managed services model versus model growing internal headcount |

- Stand up ongoing category management. After sourcing, our research shows that up to 30% of procurement savings evaporates for a myriad of reasons – whether due to:

-

- Pricing overcharges

- “Maverick” spending

- Supplier non-compliance

- Supplier gamesmanship

- Limited savings tracking

To ensure projected financial impact of NFR expense reduction programs materializes in P&L improvements, we recommend developing a thoughtful plan for NFR savings tracking and sustainability.

Best-practice category management entails a highly data-driven approach to managing deals. Retailers need to collect line-item detail data from suppliers, thoroughly cleanse and normalize the data, analyze the data leveraging category-specific analytics, and continually monitor spend and KPIs via procurement-focused data visualizations that drive insights (e.g., billing errors, SKU rationalization, failure to meet supplier SLAs, incremental demand optimization opportunities). Establishing strong category management practices for NFR spend may seem cumbersome, but these actions are critical to ensuring P&L impact and driving continuous cost reduction.

The Bottom Line

A concerted focus on NFR expense management can deliver rapid impact to retailers’ P&Ls in the form of a 90-150 bps improvement to return on sales. Yet when finance and operations leaders in retail organizations ask themselves if their NFR expense management is world class, the honest answer is generally “not even close.” Fortunately, the journey to effective NFR expense management can often be measured in quarters, not years, and the ROI to retailers is compelling.

About the Authors

Erik Trum

Manager

Erik is an experienced client engagement lead with a track record of delivering meaningful cost savings and growing Procurement’s influence within the organization. He has guided procurement engagements across a wide range of spend categories, including raw & direct materials, transportation, MRO & supplies, HR, and marketing. Erik has most recently led strategic sourcing engagements with clients in the retail, manufacturing, and media/entertainment industries.

Brian Prantil

Senior Vice President

Brian is a Senior Vice President at Insight Sourcing Group and has over 20 years of procurement and strategic sourcing experience across a wide range of Indirect and Direct categories. He previously worked for McKinsey & Co and Deloitte Consulting. Brian is a client delivery executive with responsibilities for overseeing project execution and ultimately EBITDA improvement for clients.