CFO’s Don’t Trust Procurement’s Reported Savings…

And Guess What – They’re Right.

Introduction

It is clear that there is a competitive advantage that can be gained from having a strategic procurement function in your organization. But after reviewing your profit and loss (P&L) report, you might be wondering why procurement’s projected savings was not ultimately realized to have a measurable impact on EBITDA.

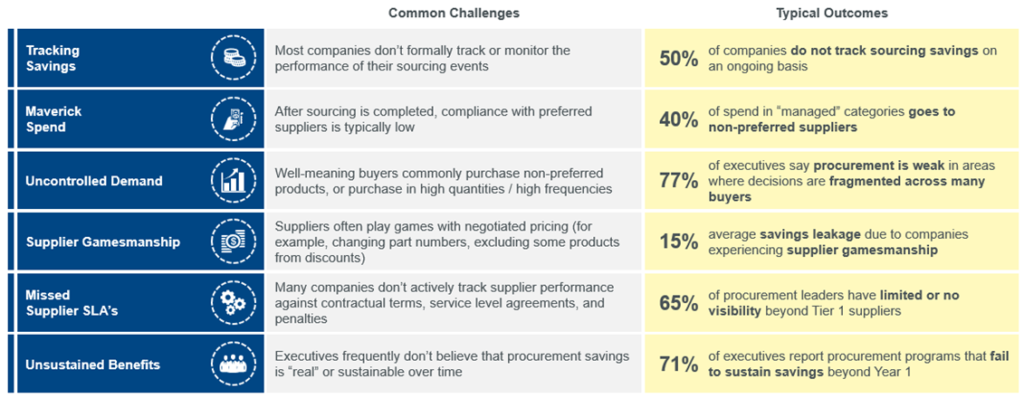

Up to 40% of procurement savings evaporate post-sourcing for multiple reasons. It could be because of supplier gamesmanship or maverick spending off contract. Regardless of the reason, the savings aren’t impacting the bottom-line like procurement leaders are promising. And CFOs can develop distrust of procurement as a result.

It might be easy to place the blame on procurement. However, the problem is much more nuanced. While CFOs and CPOs have a shared financial responsibility of driving savings to the bottom line, a lack of strategic alignment is often the root cause of a failed sourcing event.

In this guide, we’ll take a look at why CFO and CPO alignment is a vital ingredient to seeing savings stick. Plus, we’ll give you our playbook on how to get these two roles to work off the same page.

Understanding the Rift Between CFOs and CPOs

All too often, finance feels that they are not getting the savings procurement promised. Meanwhile, procurement feels like they don’t have a seat at the table. Does this dynamic sound familiar?

One way to understand the relationship between the two is to view it through the lens of sibling rivalry. Since it’s the CFO’s main responsibility to manage the organization’s money and to make the strategic decisions that ensure corporate goals and objectives are attained, it’s natural that the CFO would assume the role of the older brother.

After all, the CFO is the one that is usually included in all the strategic meetings with the CEO and board and is often seen as a partner to the CEO. In turn, procurement is left to play the secondary role of the younger sibling. This dynamic is especially true in organizations where the CPO directly reports to the CFO.

In this situation, procurement is usually seen as tactical and less strategic. The picture that comes to mind is one where procurement is strong arming vendors to get the lowest price possible. As a result, they often draw the ire of the other departmental heads because they restrict the free choice of suppliers and can cause more work by requiring processes to be followed.

To the CFO and other executives, the CPO’s inability to tie their activities to the corporate mission often results in mistrust. And since they lack the data or visibility in spend to back them up, they are unable to communicate the value procurement provides – particularly if the savings are not adding up.

But all of these differences only do one thing: they keep the organization from gaining a competitive market advantage. So, if finance and procurement have the shared financial responsibility of making savings “stick,” why is it that procurement’s strategy is not aligned to the CFO’s long term goals? It essentially boils down to a lack of a common vocabulary, objectives, and measurement.

In the world of finance, terms and metrics like revenue, profit, and loss are well defined and easily understood across the organization. These terms are important when communicating the business’s financial performance internally and externally.

By contrast, the world of procurement is much more vague. For one, metrics and terms like spend under management, influenced spend, or realized savings, vary across industries. It makes it hard for procurement to tout what they bring to the table, leading to distrust when they can’t effectively communicate what savings have occurred.

Closing the Gap between CFOs and CPOs

To close the gap requires an active partnership between the two. From the CFO side, they need to take an active role in procurement. That means equipping the team with the resources and tools they need to be effective and including them in strategic discussions. It also requires a shift in mindset in how procurement is viewed, moving away from being seen as a savings mechanism to a revenue enhancer instead.

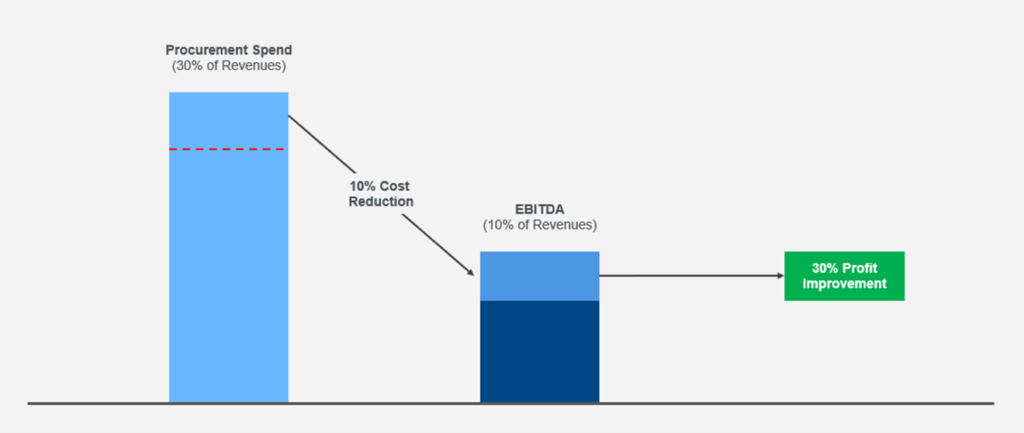

Consider this example. A company’s spend on non-payroll expense is greater than its EBITDA. With a 1% decrease in spend, EDBITDA can increase by more than 1%. But in most cases, a company’s procurement spend is many times it EBITDA, so a 10% reduction in spend can have an impact of 20% to 40% improvement in EBITDA. There are few performance-improvement levers that offer such a dramatic, immediate impact. For a company to see an impact from net new sales, they would need to see an increase of $5 to $20 to generate a single dollar in EBITDA impact.

From the CPO perspective, they need to become more strategic. CPOs have to build better relationships with their CFOs and stakeholders by learning to speak their language. It also means using data and visualizing it in a way that the CFO cares.

What Most CFOs Get Wrong

What Most CPOs Get Wrong

What High-Peforming Organizations Get Right

Organizations that have seen the savings stick know that the key to achieving this objective centers around finance and procurement alignment. In these organizations, procurement and finance work together to map procurement’s goals to the corporate mission and strategy.

Since procurement is better able to demonstrate its impact, it can properly communicate the need for managed spend. Likewise, because the CFO is more involved in procurement’s activities, they establish an active partnership developing guidelines for calculating, tracking, and measuring savings that map to P&L.

In turn, procurement is better able to keep track of spend through regular meetings with the CFO. Important to note that in high-performing organizations, CPOs tend to have a more strategic role. They actively look to build relationships not only with the CFO but also business unit leads to explain the importance of their initiatives. In addition, CPOs in these organizations are better able to articulate why spend under management is a need.

For example, if procurement and finance are working to drive savings in IT, they would actively engage the business to understand how it can be achieved. This is a much better approach than having procurement find the cheapest vendor and forcing IT to use them. By taking this approach, procurement is better able to gain organizational buy-in while keeping an eye on how it provides value to the business. They become a strategic adviser to the CFO and CEO instead of just doing what the CFO asks.

Since data related to spend under management is captured under one system, there is greater visibility into how savings flow through P&L (more on this topic in the next section).

What CFOs in High-Performing Organizations Get Right

What CPOs in High-Performing Organizations Get Right

The Path to Alignment Between CFOs and CPOs Starts With Data

The start of finance and procurement alignment begins and ends with data. Without it, there’s no way to actually measure the savings impact to the bottom line, much less track it after a sourcing event.

High-performing organizations understand the importance of equipping their team with the necessary tools. They know that for procurement to get 80% of spend management under control, they need the right resources to give them the visibility and insights needed to be effective.

Ultimately, this requires having the right data strategy. That means breaking down data silos and harnessing the power behind the numbers. However, most procurement teams lack the skill set and time to do the “pick and shovel” work that will allow them to proactively plug the savings leaks.

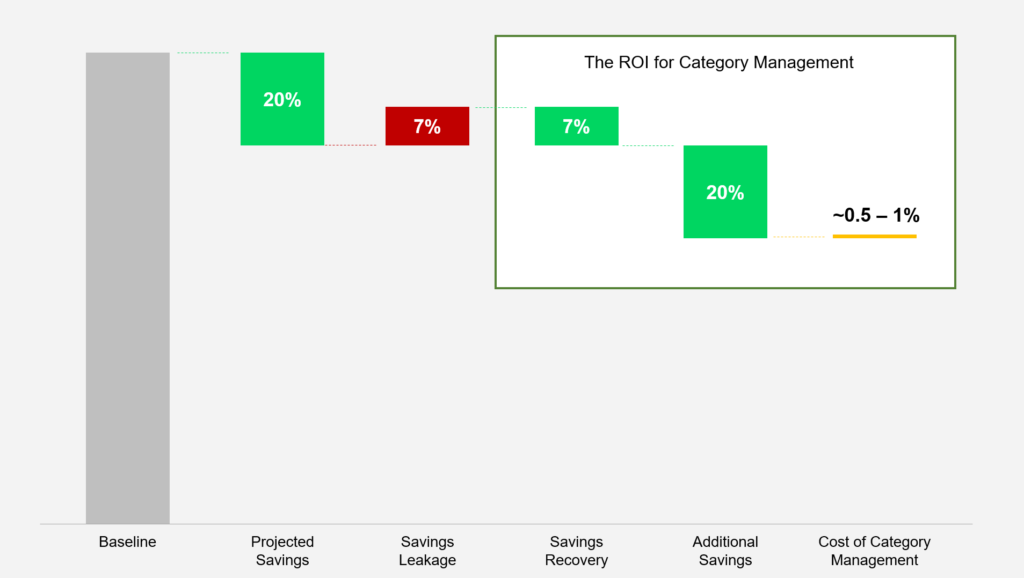

Category Management failures result in loss of credibility with executives and stakeholders and strained vendor relationships. Consequently, leading companies are developing robust category-centric data strategies to gain greater visibility into savings impacting P&L and working collaboratively with CFOs to stop savings leakage. This also includes identifying incremental savings opportunities.

Here is an example of the ROI of a category management and how the data should be tracked:

This type of data helps procurement and finance teams get on the same page with data. It would allow them to consolidate detailed category usage data across the organization, and empower CFOs and CPOs to:

- Understand what actual savings are accruing to the bottom line

- Mitigate or eliminate savings leakage after sourcing events

- Enhance and develop excellent relationships with external suppliers and internal stakeholders

Together procurement and the CFO’s office should leverage data to understand the value, prioritize actions, and assign responsibilities.

The result? A more proactive and strategic team that can leverage the data to drive sound business growth. High-performing organizations understand the value behind their data, which is why they can leverage it as part of their framework to drive value and increase their competitiveness.

Conclusion

Procurement has historically been viewed as a back-office function. Instead, it should be considered a revenue enhancer — another lever you can pull to stretch the dollars you currently have. After all, isn’t the savings impact of a cost management initiative that is equivalent to opening five stores more attractive?

By establishing a baseline of meaningful taxonomies that can be benchmarked and reviewed with spend visibility tools like Insight Analytics, you can create a space of true collaboration between the CFO and CPO.

Once you have them working together as one team, the ability to achieve a competitive advantage becomes more accessible and more strategic.