What does an effective natural gas purchasing strategy look like?

by Ben Saunders, ISG Enterprise Energy Solutions

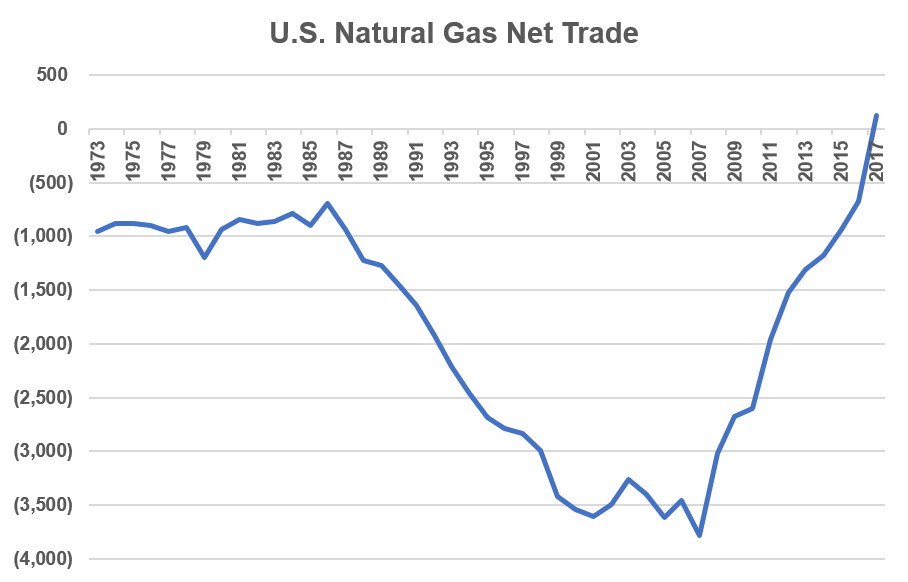

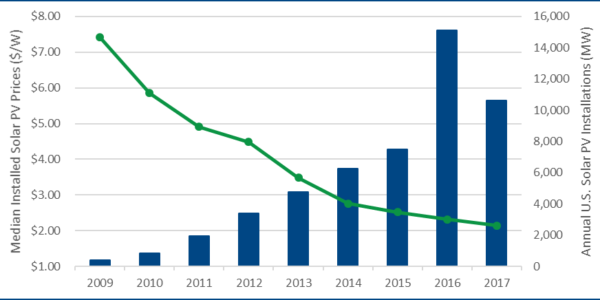

The natural gas market has experienced two major shifts over the last decade. The first shift has been the development of major production centers across the country, creating a more robust supply network outside of the traditional Gulf producing region. The second shift revolves around changing policy, infrastructure, and energy consumption trends which have created new demand drivers for the fuel. Natural gas production is currently at an all-time high as demand for the commodity continues to aggressively trend upwards. In fact, in 2017 the U.S. became a net exporter of natural gas for the first time since 1957 due in large part to an increase in pipeline exports to Canada and Mexico and the rapidly growing LNG export market. Moreover, a growing demand for natural gas by power generators will continue to result in a closer correlation between gas and power prices.

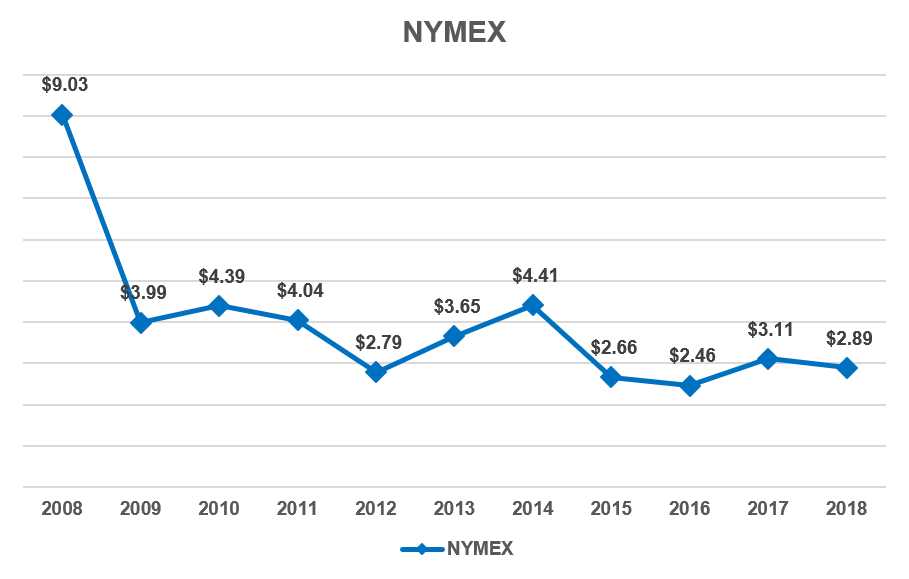

So what does this mean for your utility budget? Six out of the last 10 years, national gas prices have fluctuated by more than 20 percent. With commodity costs accounting for about 70 percent of a utility budget, these types of year-over-year changes can be devastating. And even though we are still in a low price environment, prices on a month-to-month and day-to-day basis are still experiencing significant volatility. Spot prices during peak demand season and during utility restrictions, can break an annual budget due to one volatile month.

The main risks to be addressed by an energy manager are price, service requirements, and counter-party risk, all of which can be addressed through a strategic and proactive procurement approach, best-in-class contracting practices, and disciplined sourcing execution.

- Price – Customers are ultimately market takers, and of course, commodity prices rise and fall over time. The goal for a company should not be to beat the market or to expect price decreases every year, but to determine realistic goals based on their businesses needs and market expectations. Does your company value price certainty and budget stability? Is it important that your utility prices are not out of market for any given fiscal period? A company should consider its appetite for budget movement and time horizons for planning when making these decisions.

- Service Requirements – Tied closely to price, poor service requirements can alter a budget for scenarios that are not addressed in contracting. A common mistake we see during contracting is that companies do not address pricing and obligations for all volumes and delivery periods throughout the contract. Do your contracts explicitly state pricing points for all volumes? How will your supplier perform during utility curtailments? What communication do you have established with your supplier during adverse market conditions? All of these factors can and need to be addressed during the contracting and award process, and suppliers should be held accountable for maintaining their obligations.

- Counter-Party Risk – Low price levels and volatile markets in recent years have caused financial strain for many providers, resulting in significant vertical and horizontal consolidation across the energy retail supply chain. There are two problems that stem from this environment. The first is that market consolidation results in more restricted markets for retail customers. Fewer competitive, reliable supplier options require more unique contracting structures and greater transparency to maintain price competitiveness. The second problem is that financial strain on suppliers can result in unforeseen changes to contract obligations. Changes in ownership and calls for credit from suppliers can reduce the total value of the contract to the customer.

Procurement Strategy: Addressing Risk

Proactive Purchasing: Although customers must deal with both rising and falling markets over time, customers can work to mitigate budget fluctuations from year to year and work to hit internal targets. Many customers have the practice of extending contracts 30 to 60 days from termination. In order for a purchasing strategy to be effective, the market must be monitored constantly for opportunities to achieve internal goals: executing price reductions, hitting budgeted targets, avoiding additional cost increases. Moreover, the strategy should consider how far in advance the business is willing to act and what portion of volume needs should be executed with each purchase. By consistently monitoring and executing prices throughout the year, customers can minimize swings in their budget and reduce the risk associated with each purchase.

Best-in-Class Contracting: Another common mistake is allowing price value to deteriorate through poor contracting practices. Several contracting mistakes include not addressing or understanding a supplier’s delivery obligations, not addressing pricing for all delivered volumes and cost components throughout the term, and allowing for unfavorable extension terms.

Disciplined Sourcing Execution: ISG Energy promotes competition in almost every sourcing event. Creating cost transparency and challenging suppliers to contribute value through creative product offerings, empowers companies to drive the decision process and ultimately retain long-term value. The value created through price competition and transparency shouldn’t be lost because of a lack of understanding of the total value of the contract. Customers should develop the habit of reviewing suppliers’ credit requirements, financial health, operational footprint, and roles with other parties in the supply chain. This will help avoid unforeseen events throughout the term of an engagement that reduce value for the customer.

The natural gas market is at the center of changing policy, regulation, and infrastructure in America. The volatility and risk that this creates for commercial and industrial customers is an unavoidable issue. Customers must be proactive in developing and executing a purchasing strategy that best positions them to effectively manage this cost line item.